When it comes to your financial institution, many people look to big banks for their wide array of products and services. But in this day and age when fees are at an all time high and options for more financial freedom seem limited, there could be an answer to your needs right in your very own backyard. On the surface, credit unions may seem similar to banks. From the outside, you will typically see the same view you have become accustomed to at a bank: drive thru teller lines, ATMs, typical stuff. But there are a few key differences, and those differences lie within the walls of the institution.

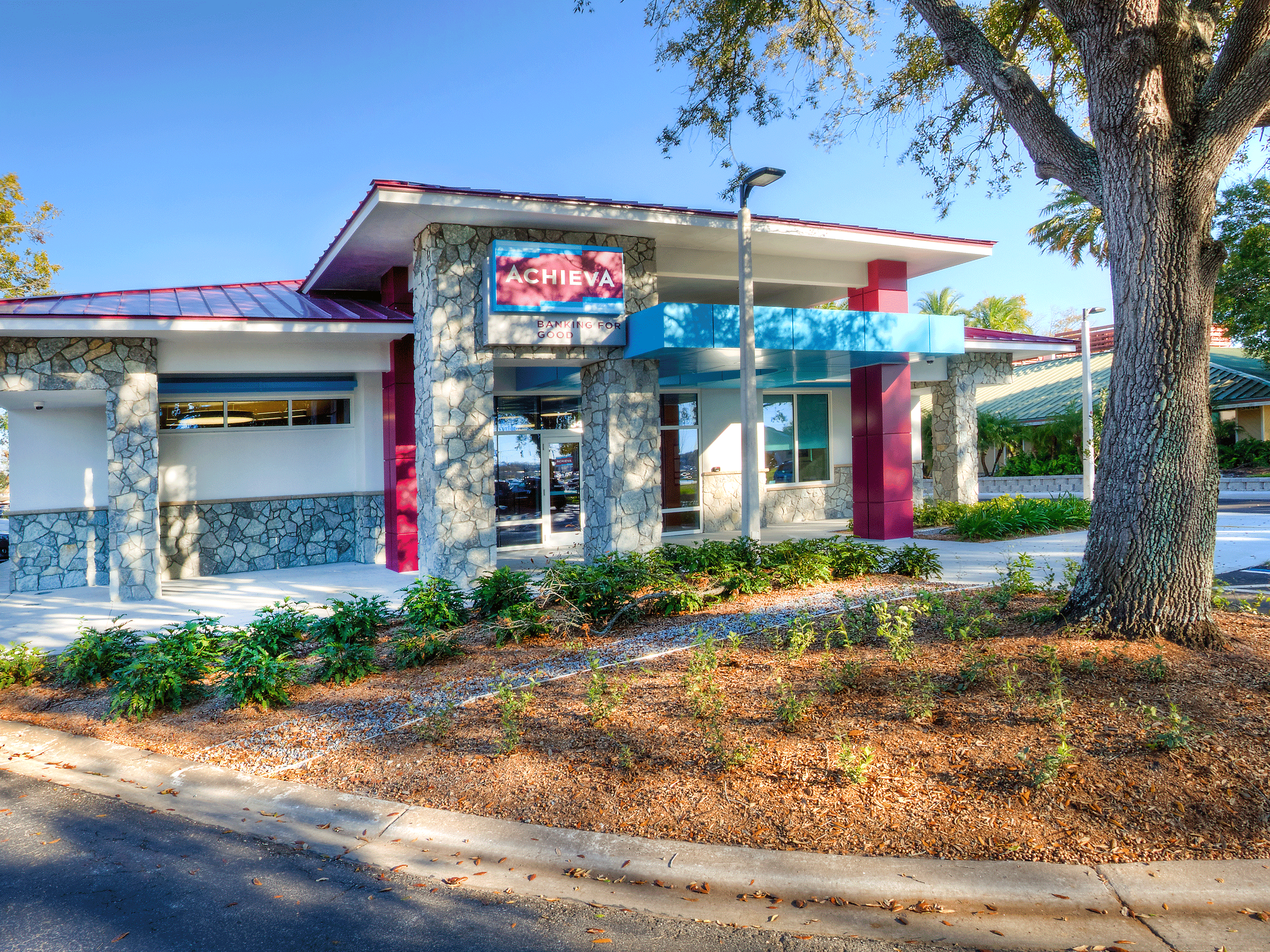

In the early days of credit unions, there was usually some type of common quality the members shared, which essentially allowed them to have a piece of the shared pie. Achieva, for example, began as the Pinellas County Teachers Credit Union, with membership strictly limited to teachers in Pinellas County. Today, Achieva welcomes members of all ages and occupations throughout our nine county service area.

Many people don’t think to look to their local credit union for financial support – mainly because they don’t know that they are even allowed to join! Well, we are here to tell you that is simply not true, and there are many reasons why you can – and should – join a credit union.

Here are some common misconceptions about credit unions, and the truth behind them:

Credit unions have strict membership requirements

Not true! We want your membership! Credit unions are cooperatives – meaning that their members are all owners of the organization. The services of credit unions come full circle in the fact that they exist to serve their members. While there may have been more restrictions when credit unions were first established, today it is easier than ever to become a member at a credit union.

More fees

While it’s true that most credit unions have a small membership fee, that doesn’t mean that your money is going down the drain. When you pay to become a member of a credit union, you become a part owner of the organization. Credit unions are cooperatives, meaning that any money that goes into the institution is returned to its members in various ways. Achieva’s $15 membership fee ensures that you are a lifetime member in the organization and you own at least one share of the credit union.

Credit unions don’t offer as many products as a bank

This is probably one of the most common fallacies associated with credit unions. In most cases, credit unions offer all of the same products as a bank, and then some. From checking and saving accounts to loans, mortgages and retirement planning, credit unions offer many comparable services that you would typically find at a bank.

Credit unions have fewer locations than banks

This may be true for some credit unions, since many specialize in serving specific areas. However, the truth is that credit unions are expanding. And with the convenience of online and mobile banking, it is easy to do your banking with a credit union from anywhere.

There is a different level of service

This is actually true – but not in the way you think! Most credit union members are treated with a more personal and friendly type of service than big bank customers. It’s just part of the culture – we treat you like extended family!

The best way to combat theses misconceptions is to see for yourself! Check out your local Achieva branch and experience the difference of banking with a credit union!