Where do you go for inspiration when you want to save money? For most people, social media, streaming news apps, and YouTube are the top preferred. However, Achieva Credit Union introduces an additional tool you can use for financial planning. Best of all, it’s totally free!

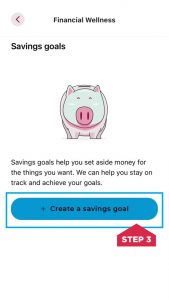

Introducing Achieva’s Savings Goals, the feature that helps you track your spending and savings timelines. Creating a goal is easy and takes only minutes using your mobile device.

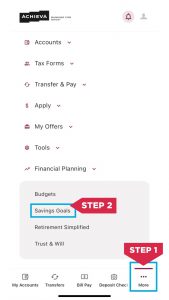

How to access the Savings Goals feature

Members can access the main menu in the Achieva Mobile App to select Financial Planning. From there, tap Savings Goals to create a goal.

Ready to try it but not sure where to start? No problem. Below are three practical ideas where you can apply your savings.

Prepare for emergencies

An emergency fund provides a cushion if you incur unexpected expenses. It can cover things like medical bills, emergency travel, or car repairs. When you have an emergency fund, you avoid taking high-interest loans. Additionally, having an emergency fund will leave time to deal with the actual emergency rather than searching for how you will pay for it. When prioritizing your savings goals, put this one at the top.

Save for a down payment

Purchasing a car is exciting. It’s even more exciting when you have a down payment to go with it. Putting money down reduces the amount you’ll need for an auto loan. Many people feel relief when they provide a down payment since, on average, every $1,000 down reduces the monthly fee by at least $15.

Complete your home improvements

Let’s face it. Home improvement costs have gone up in the last few years. Because of this, most households must save for several months before being able to afford any upgrades. Establishing a savings goal within the Achieva Mobile app will let you see how close you are to your new kitchen or bath. Plus, the feature has convenient funds transfer options for even quicker results.

Are you new to Mobile Banking?

If you’ve not yet registered for Online or Mobile Banking, check out this related article about digital banking benefits. There’s so much you can do, and transactions can be completed instantaneously.

As always, our Member Service Center is happy to help you with any questions. Please call 800.593.2274 (toll-free) for support.

Need more financial content? Continue following the Achieva Life Blog for additional budgeting and lifestyle articles.